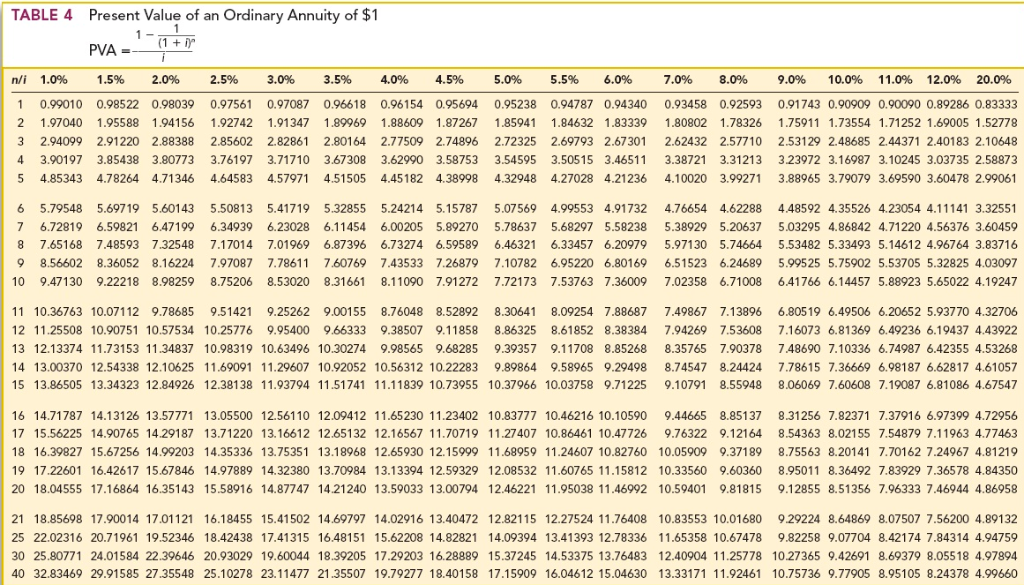

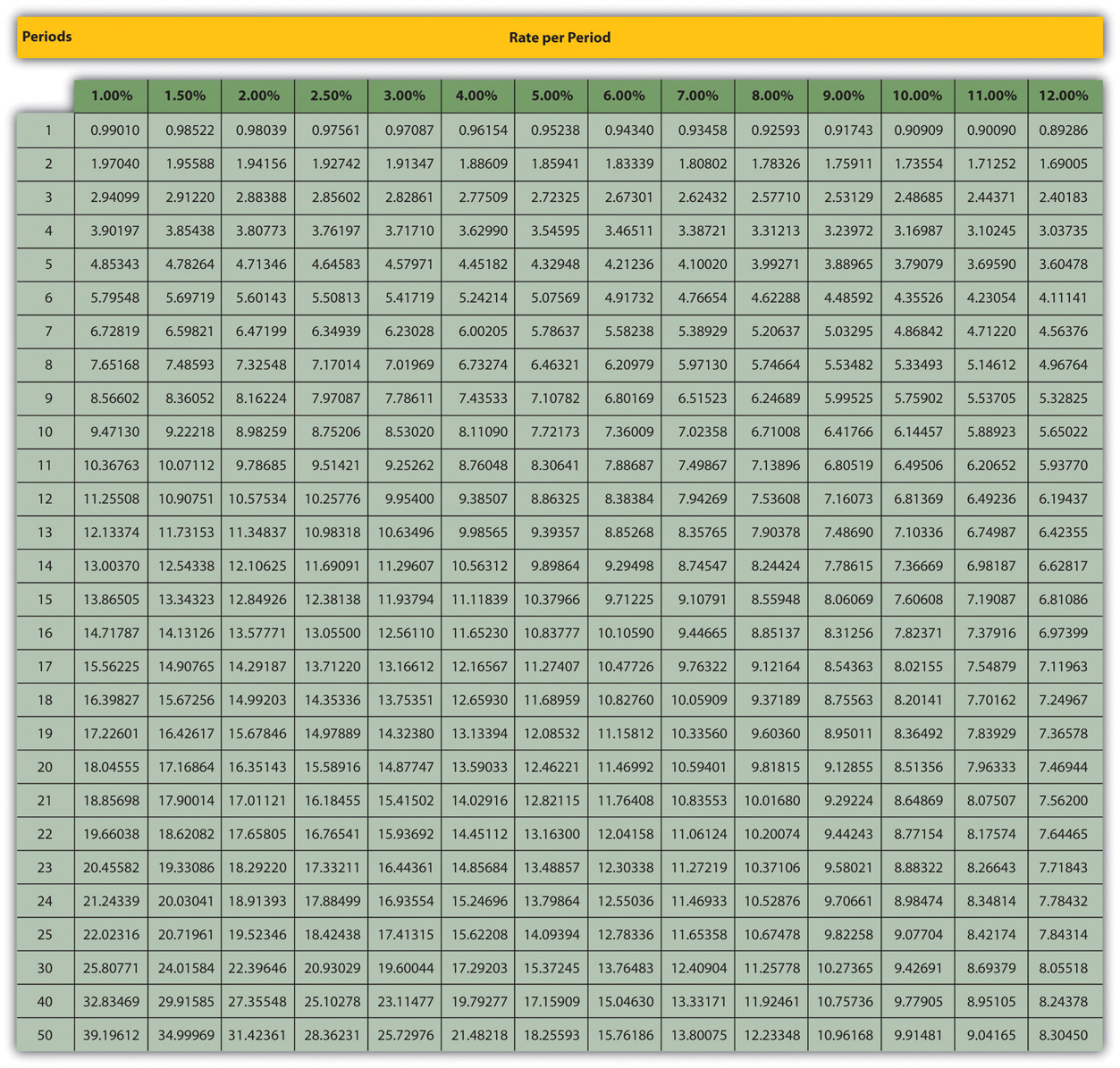

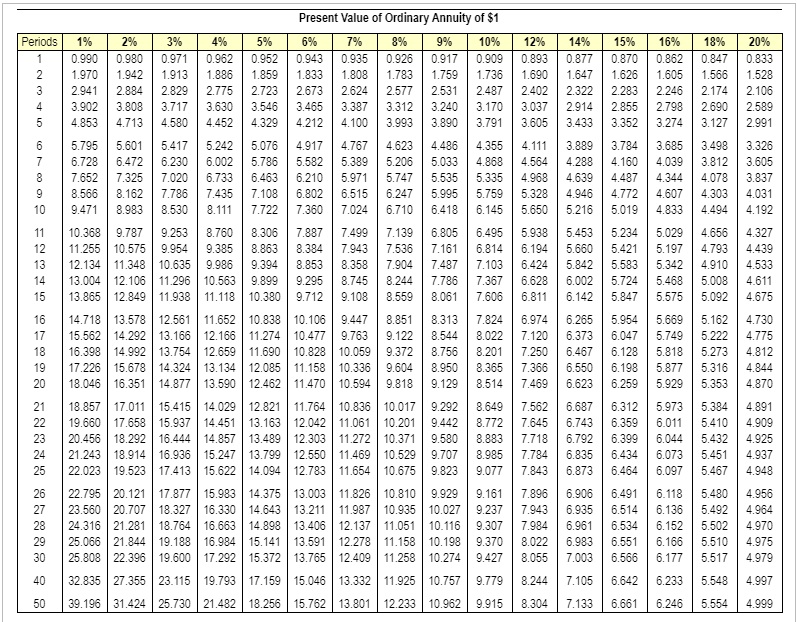

Present value of annuity table of $1

Alternatively we can compute present value of an annuity using present value of an annuity of 1 in arrears table. More study material from this topic.

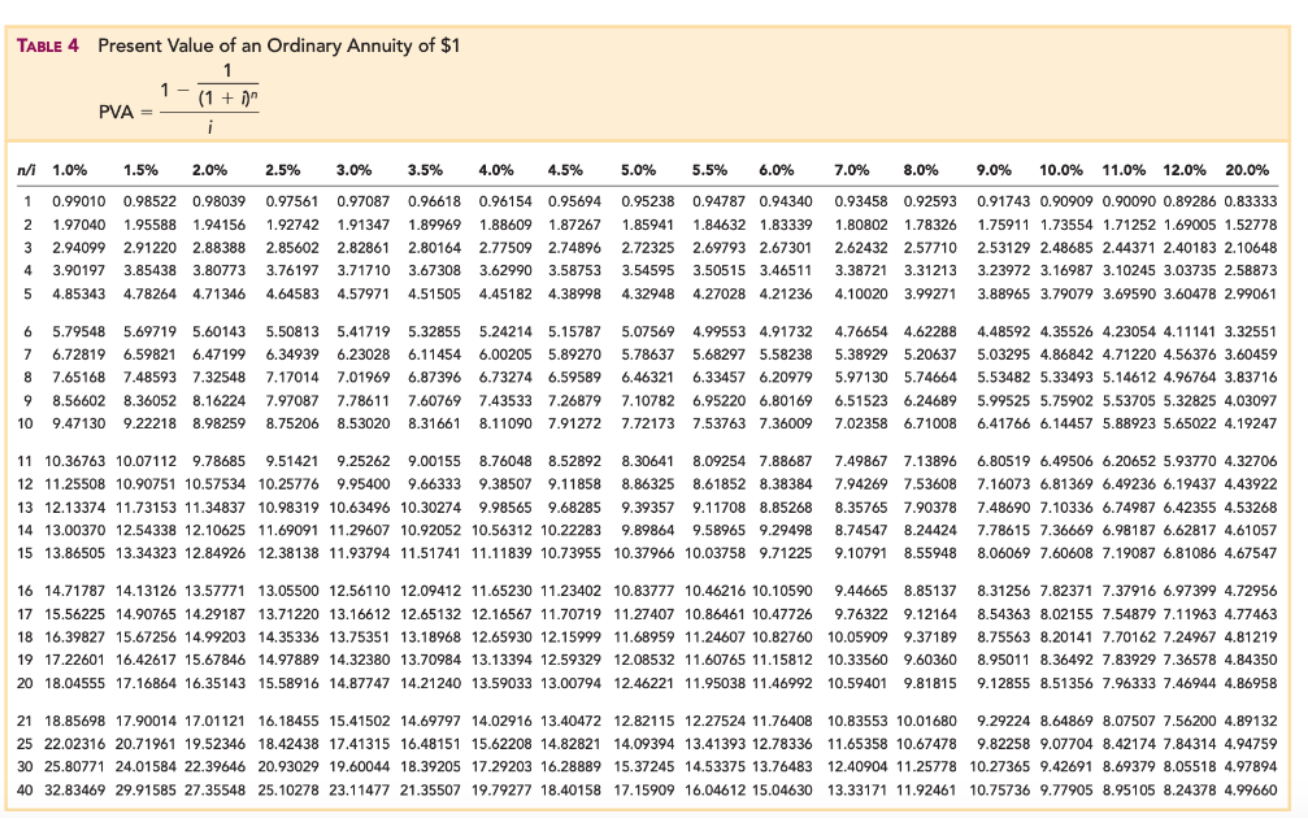

Table 4 Present Value Of An Ordinary Annuity Of 1 Chegg Com

However the expert valuation of those new IP gave their market worth to be N 4440929.

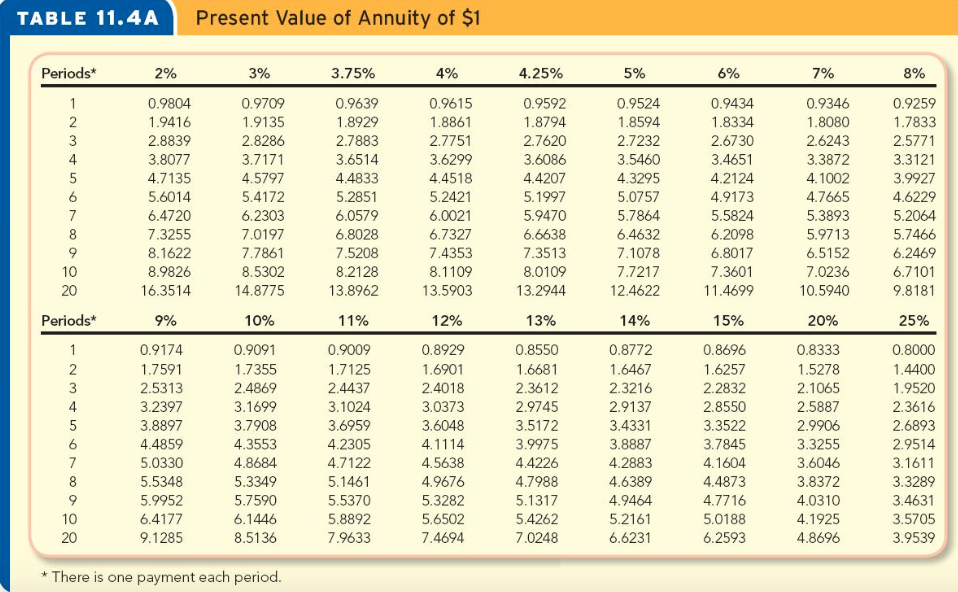

. Thus if you expect to receive 5 payments of 10000 each and use a discount rate of 8 then the factor would be 43121 as noted in the table below in the intersection of the. It is used to calculate the present value of any single amount. It may be labeled Present Value of and Annuity of 1.

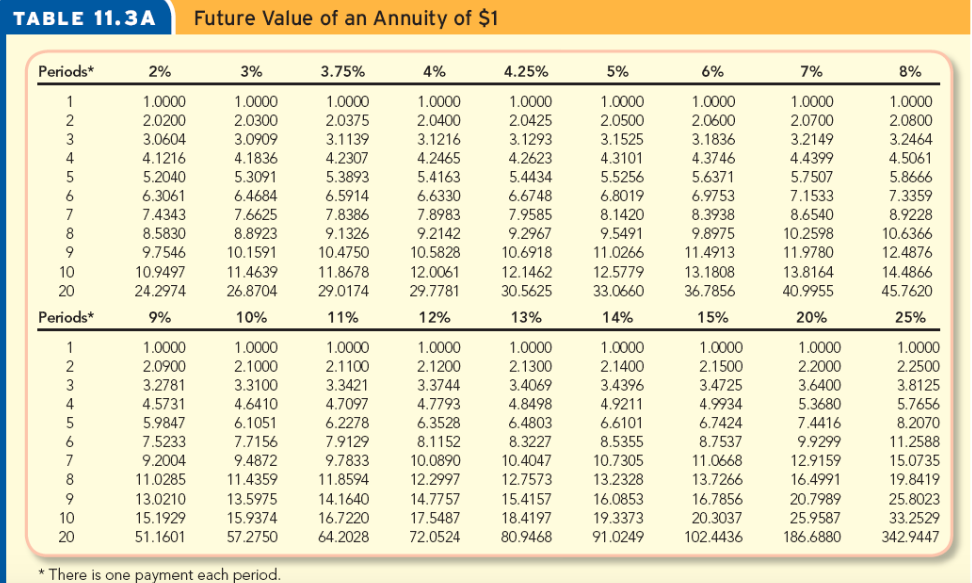

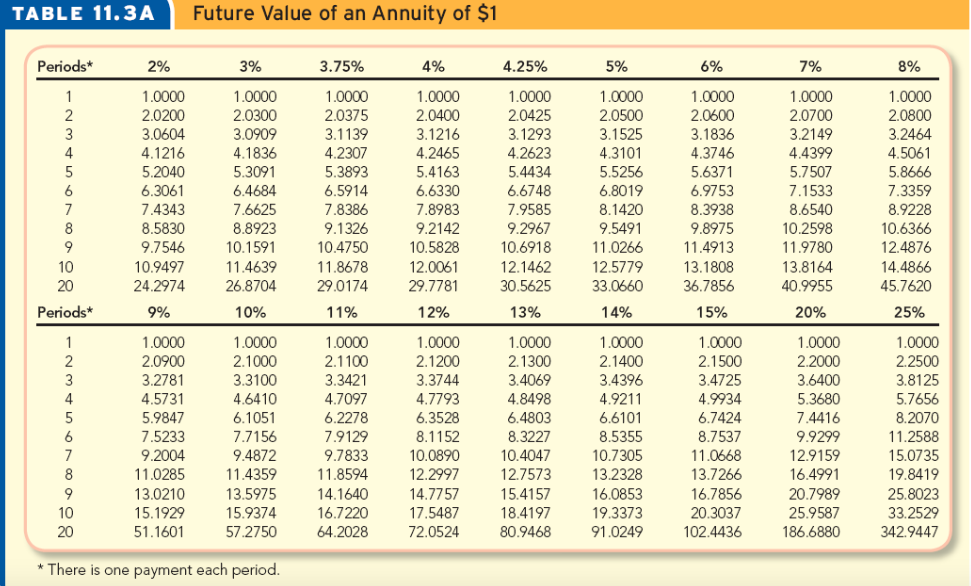

All the data tables. The annuity is the principal and interest payments you make every. Difference Between Pv Annuity And Pv Of 1 Tables.

Present Value Of Annuity Formulas In Excel. Present value of annuity table of 1. PVIFA stands for the present value interest factor of an annuity.

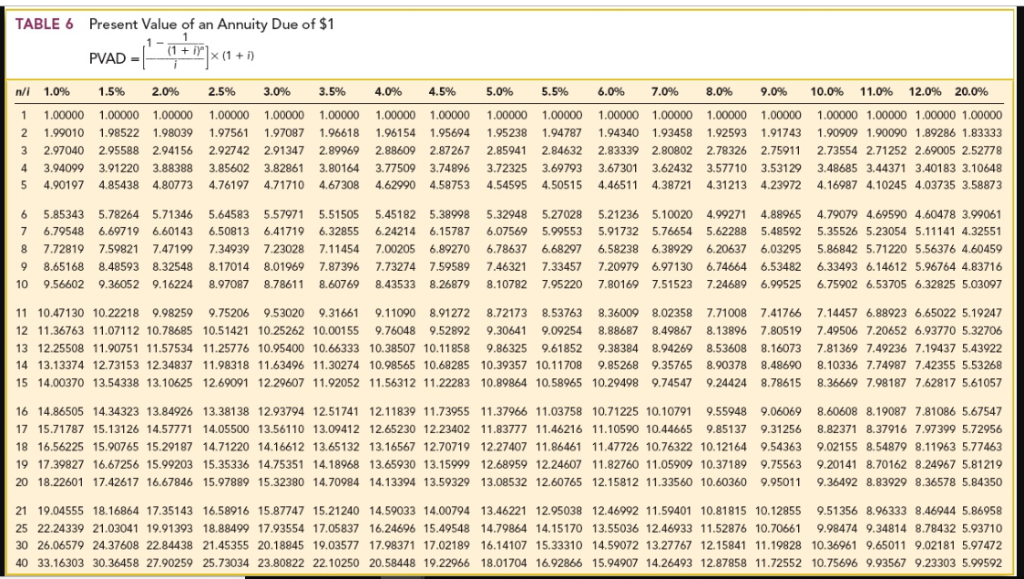

Related Present Value Annuity Due Calculator Future value of a. Therefore the present value of annuity due table refers to calculating the value at the end of given periods using the current value of money. This table contains the present value of 1 to be received.

The total of all payments compounded for the appropriate number. Example PageIndex investigates and develops an efficient way to calculate the present value of an annuity by relating the future value of an annuity and its present value. 153 rows PVA present value of annuity C amount of equal payments r interest rate per period n number of periods Present Value of Annuity Table The following present value of.

PV PMT latex left frac1-. This means that the company produce the new IPs cheaper than their market price by as much as N. It is a metric that can be used to calculate a number of annuities.

The present value of the annuity is calculated from the Annuity Factor AF as. Date General Journal Debit Credit 1 Jan 1 2020 Right of use asset 52756 Lease Payable 52756 January 1 2018 Lease payable 29000 x476654138230 present value View the. Annuities provide guaranteed returns by participating in market gains but not the losses.

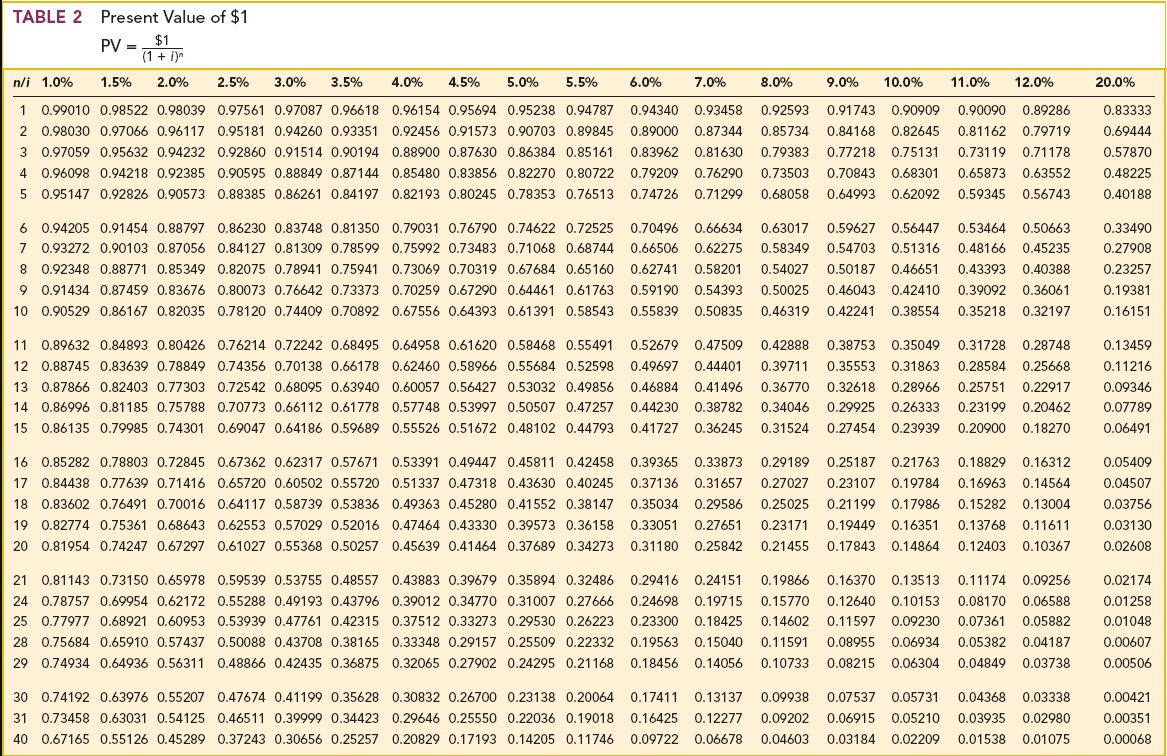

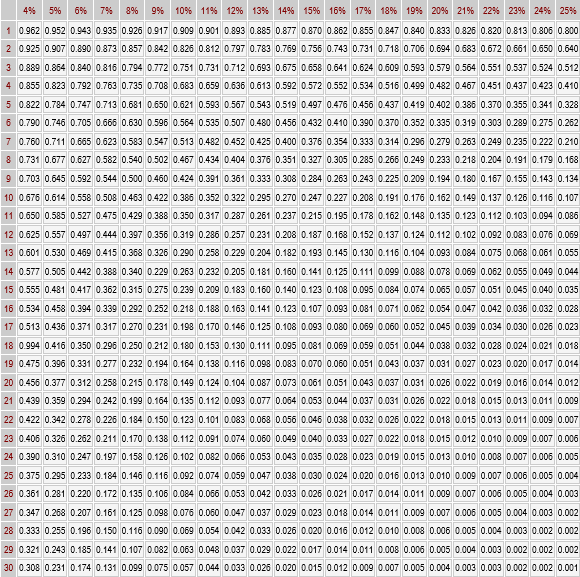

Ad Annuities help you safely increase wealth avoid running out of money. This table shows the present value of 1 at various interest rates i and time periods n. Methods for the evaluation of capital investment analysis.

AF x Time 1 cash flow. Thus if you expect to receive 5 payments of 10000 each and use a discount rate of 8 then the factor would be 39927 as noted in the table below in the intersection of the. Present Value of 1 Table.

Formulate a Solution Strategy The present value of the annuity can be computed using equation 5-4 as follows. Therefore the interest rate is 2 quarterly or 8 annually. Average rate of return or accounting rate of return method.

Present Value Of An Ordinary Annuity Of 1 Download Table

Solved Present Value Of Annuity Of 1 Table 11 4a Periods Chegg Com

Present Value Of 1 Annuity Table

Appendix Present Value Tables Financial Accounting

Present Value Of Ordinary Annuity Table Accountingexplanation Com

Solved Table 1 Future Value Of 1 Fv 1 1 I N I 1 0 Chegg Com

Solved Present Value Of Annuity Of 1 Table 11 4a Periods Chegg Com

Solved Present Value Of Annuity Of 1 Table 11 4a Periods Chegg Com

Present Value Of 1 Table Accounting For Management

Solved The Present Value Of 1 Table The Present Value Chegg Com

Solved Table 4 Present Value Of An Ordinary Annuity Of 1 1 Chegg Com

Present Value Of 1 Table Accountingexplanation Com

Solved Table 6 Present Value Of An Annuity Due Of 1 1 I Chegg Com

2

2

Future Value Of 1 Table Accountingexplanation Com

Present Value Of An Ordinary Annuity Of 1 Download Table